Again, it all comes down to run the risk of. The even more miles you drive in your vehicle annually increases the probability of an accident. The person with an hour-long commute might pay greater premiums than somebody who, claim, works from residence. To help you recognize your coverage as well as choose the appropriate amount for your lifestyle and also spending plan, speak to your ERIE Representative. affordable.

What Is Responsibility Vehicle Insurance? Obligation automobile insurance coverage is the part of an auto insurance plan that offers economic protection for a motorist that hurts somebody else or their residential property while operating a lorry. Automobile obligation insurance only covers injuries or damages to 3rd parties as well as their propertynot to the chauffeur or the vehicle driver's residential or commercial property, which may be individually covered by various other parts of their plan. low cost auto.

In several states, if a vehicle driver is located to be liable in the crash, their insurance policy business will certainly pay the residential or commercial property and also medical expenditures of various other parties associated with the mishap as much as the limits established by the policy (dui). In states with no-fault automobile insurance coverage, nevertheless, motorists entailed in an accident should initially file a case with their very own insurance provider no matter who was at fault.

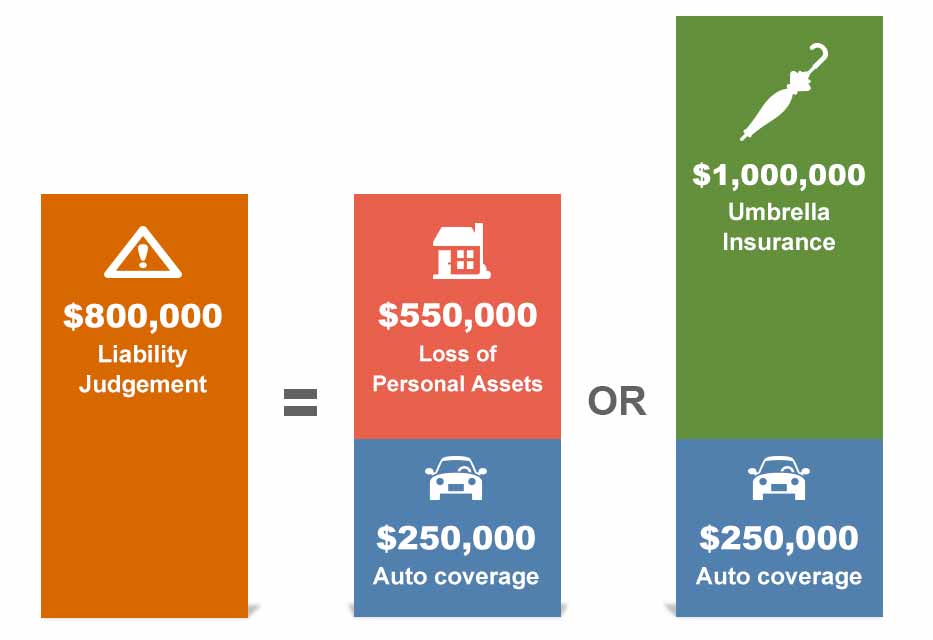

Any type of expenses that exceed the restriction end up being the responsibility of the at-fault motorist. Responsibility Restriction for Bodily Injury per Person The per-person restriction is the maximum amount that the insurance provider will certainly pay for every individual that has actually been injured in an accident. Liability Restriction for Bodily Injury per Accident The obligation limit per mishap is a financial cap for the overall amount that the insurance coverage firm will certainly pay for all of the people included in a crash.

Indicators on Automobile Insurance Faqs - Aldoi You Should Know

The at-fault vehicle driver would after that be liable for any clinical expenditures above that limit (accident). Note Bodily injury obligation insurance coverage can safeguard your house and various other properties in the event that you're sued by a vehicle driver or guest complying with a mishap. Needs for Responsibility Vehicle Insurance policy Each state establishes a minimum for exactly how much responsibility insurance coverage a driver must carry.

Instance of Obligation Vehicle Insurance Policy Right here is an instance of exactly how responsibility auto insurance may operate in a state without no-fault insurance coverage. Allow's say the driver had the adhering to obligation auto insurance coverage with their insurance policy firm: Bodily injury obligation restriction per person of $60,000 Physical injury limit per crash of $150,000 The insured gets right into a mishap involving several individuals and is ruled at-fault for any type of damages.

The total costs for everyone involved (except the at-fault driver) was $120,000, which is much less than the per-accident physical injury restriction. car insurance. It is necessary to keep in mind that some plans will certainly not cover any type of expenses beyond the per-accident limit even if the per-person limits have actually not been surpassed. Making use of the example over, let's claim each individual had medical costs of $55,000.

Therefore, the at-fault chauffeur would certainly be liable for the additional $15,000. Vital While states established compulsory minimums for automobile insurance policy obligation protection, acquiring even more than the minimum is usually a clever step. Liability vs. Full-Coverage Automobile Insurance policy Along with the responsibility coverage your state requires, insurance providers provide coverage known as accident as well as detailed insurance policy.

The smart Trick of Does Liability Insurance Cover Theft? - Suntrup Nissan That Nobody is Discussing

Comprehensive normally covers damages from fire, vandalism, or dropping objects, such as a huge tree limb or hail. These two kinds of insurance coverage are optional for vehicles that are owned cost-free as well as clear. If the car is financed, the lender might need that you have them. The loan provider wishes to safeguard the vehicle's worth considering that it serves as security for the finance.

Since much of these provisions can differ from one state to another, it's worth speaking with a knowledgeable insurance agent or broker that recognizes with your state's guidelines. It's additionally useful to compare vehicle insurance prices to ensure that you're getting the most effective bargain on coverage.

Obligation car insurance coverage is the very best way to safeguard yourself against considerable monetary loss in case of a cars and truck accident where you're at fault. No one suches as to think of something similar to this happening, yet when you're faced with a severe vehicle accident, the last thing you desire to need to bother with is if there will certainly suffice money or vehicle insurance to cover injuries and damages.

What Is Responsibility Cars And Truck Insurance and What Does It Cover? Responsibility insurance policy covers the driver of one more vehicle if you are in an accident that is your mistake.

Some Known Factual Statements About What You Need To Know - Minnesota Department Of Public Safety

If you are struck by somebody else, and also it's their fault, their responsibility insurance policy will certainly cover damage to your vehicle as well as your clinical expenses. There are two types of liability insurance policy: Bodily Injury Liability, Bodily injury obligation covers the vehicle driver as well as residents of the other cars and truck if you cause an at-fault crash causing injuries.

Physical injury responsibility covers clinical costs, pain and suffering as well as earnings shed by the various other individual as a result of not being able to work while recouping from injuries - cheapest car insurance. Property Damages Liability, Residential or commercial property damage liability insurance covers damage to the other person's building, normally their cars and truck, yet it can include things inside the lorry.

The last 50 describes the quantity of home damage obligation per crash, which would additionally be $50,000. Physical injury responsibility is per individual, while residential or commercial property damages responsibility is per crash. If you hit three individuals and 3 autos in the very same mishap, your insurance coverage will certainly cover you for as much as $100,000 for the bodily injuries of individuals you strike ($100,000 maximum) and also only up to $50,000 for all 3 of the cars. affordable auto insurance.

If you include collision and also extensive insurance coverage to your policy, you and also your automobile will certainly be covered in an accident if you're at mistake. This makes the additional price of the insurance worth it to the majority of people. Accident will cover damages that occurs from hitting something, as well as extensive covers problems from burglary, climate, animals (such as hitting a deer) and also criminal damage.

The Ultimate Guide To Automobile Insurance - Official Website

Some states likewise call for uninsured driver protection (), underinsured driver insurance coverage (UIM) and personal injury protection (PIP). Despite your state's requirements, you require to have obligation insurance coverage or really deep pockets, as it's against the legislation in most states to drive without obligation insurance coverage. New Hampshire does not require responsibility insurance policy, however they do require drivers to prove they have some means of economic responsibility if they cause an accident.

You will need to spend for anything that is not covered by liability insurance, and also medical bills can increase extremely swiftly. Using Your Obligation Insurance, This example highlights just how liability insurance coverage is utilized as well as exactly how not having enough responsibility insurance may bring about you paying out-of-pocket costs. Susan is driving residence from job and strikes an additional automobile.

Susan would then be on the hook to pay the extra $22,000 not covered by her obligation insurance coverage - vehicle. What Is Not Covered by Responsibility Insurance Policy?

Below are some of the most often asked concerns regarding obligation insurance. Increase ALLDoes responsibility insurance policy cover theft? No, obligation doesn't cover theft. Extensive insurance coverage will certainly cover your automobile if someone swipes it or breaks into it and also damages it while doing so. risks. Comprehensive likewise covers weather-related damages and also criminal damage.

Unknown Facts About Liability Car Insurance: What It Covers & How Much It Costs

If you have a lending on the automobile or rent a lorry, the financing company is offering you a finance with the cars and truck's cost as collateral. If you just get liability insurance and also amount to the auto, it's unexpectedly worth much less than the amount they loaned you, as well as they have no other way to recuperate that cash. affordable.

Does responsibility insurance cover my car if I'm not at fault? If you're in a mishap and also the other person is clearly at fault, their liability insurance coverage must cover your automobile's damage.

Does obligation insurance coverage cover my vehicle if I am at fault? Obligation safeguards anybody you struck in a crash. It does not cover your medical costs, damage to your auto or other losses you experience. You will not only need to pay for the damages to the other individual's automobile, however you will additionally need to spend for the damages to your own vehicle expense.

Below are some of the most regularly asked concerns about responsibility insurance - liability. Increase ALLDoes obligation insurance policy cover theft?

The Only Guide for Understanding Auto Insurance

If you have a car loan on the vehicle or lease a vehicle, the financing firm is providing you a lending with the car's expense as security. If you just get responsibility insurance and also total the car, it's all of a sudden worth much less than the quantity they loaned you, and also they have no other way to recuperate that cash.

Does responsibility insurance coverage cover my cars and truck if I'm not at fault? If you're in an accident and also the various other person is clearly at mistake, their liability insurance coverage need to cover your car's damages.

Does obligation insurance coverage cover my auto if I am at fault? Obligation protects any person you struck in a mishap. cheap auto insurance. It does not cover your clinical costs, damage to your vehicle or various other losses you experience. You will certainly not just need to pay for the damage to the various other person's vehicle, however you will also have to pay for the damages to your own automobile expense.

Below are several of the most regularly asked questions concerning responsibility insurance. Increase ALLDoes liability insurance cover burglary? No, obligation does not cover theft. Detailed insurance policy will cover your vehicle if somebody takes it or burglarize it and also damages it in https://car-insurance-loop-chicago-il.us-southeast-1.linodeobjects.com the process. Comprehensive also covers weather-related damages and also criminal damage.

10 Simple Techniques For Car Insurance Coverages - Alfainsurance.com

affordable car insurance cheaper cars credit vans

affordable car insurance cheaper cars credit vans

If you have a finance on the vehicle or rent a car, the money business is providing you a finance with the cars and truck's price as collateral - insurance companies. If you just obtain responsibility insurance and complete the automobile, it's all of a sudden worth much less than the amount they lent you, and they have no other way to recover that money.

Accident and also thorough coverage shield the money company's financial investment. Does responsibility insurance cover my vehicle if I'm not liable? If you're in a mishap and the other person is plainly to blame, their obligation insurance policy should cover your auto's damage - insurance companies. If you're hurt in the accident, the various other person's responsibility insurance must cover that as well.

Does obligation insurance policy cover my auto if I am at mistake? Liability protects anybody you hit in a mishap. It doesn't cover your clinical expenses, damage to your automobile or other losses you experience. You will not just need to spend for the damages to the various other individual's auto, however you will additionally need to pay for the damages to your very own vehicle expense (laws).

Below are a few of the most often asked concerns regarding responsibility insurance. Increase ALLDoes liability insurance cover theft? No, responsibility does not cover theft. Extensive insurance coverage will cover your vehicle if somebody steals it or breaks into it and also damages it in the procedure. Comprehensive also covers weather-related damages as well as criminal damage.

The Facts About Automobile Insurance Guide - Texas Department Of Insurance Uncovered

If you have a car loan on the lorry or lease a vehicle, the financing company is giving you a funding with the automobile's expense as collateral. If you just obtain liability insurance policy and also amount to the automobile, it's all of a sudden worth much less than the quantity they lent you, and also they have no means to recover that cash.

insure cheaper car business insurance cheaper

insure cheaper car business insurance cheaper

Does obligation insurance cover my cars and truck if I'm not at fault? If you're in an accident and the various other individual is plainly at mistake, their responsibility insurance coverage ought to cover your car's damage.

low-cost auto insurance insured car credit score cheap car

low-cost auto insurance insured car credit score cheap car

Does obligation insurance policy cover my automobile if I am at mistake? Liability protects anybody you struck in an accident (automobile).