The solution depends on a number of aspects, including where you live, exactly how much your car is worth, as well as what other assets you need to secure. Trick Takeaways A lot of states need you to have at least a minimal amount of insurance coverage for any kind of injuries or home damages you trigger in an accident.

Comprehensive protection, additionally optional, shields versus various other dangers, such as theft or fire (money). Without insurance driver coverage, mandatory in some states, protects you if you're hit by a chauffeur that does not have insurance. Just How Cars And Truck Insurance coverage Works An automobile insurance plan is really a package of several different kinds of insurance coverage.

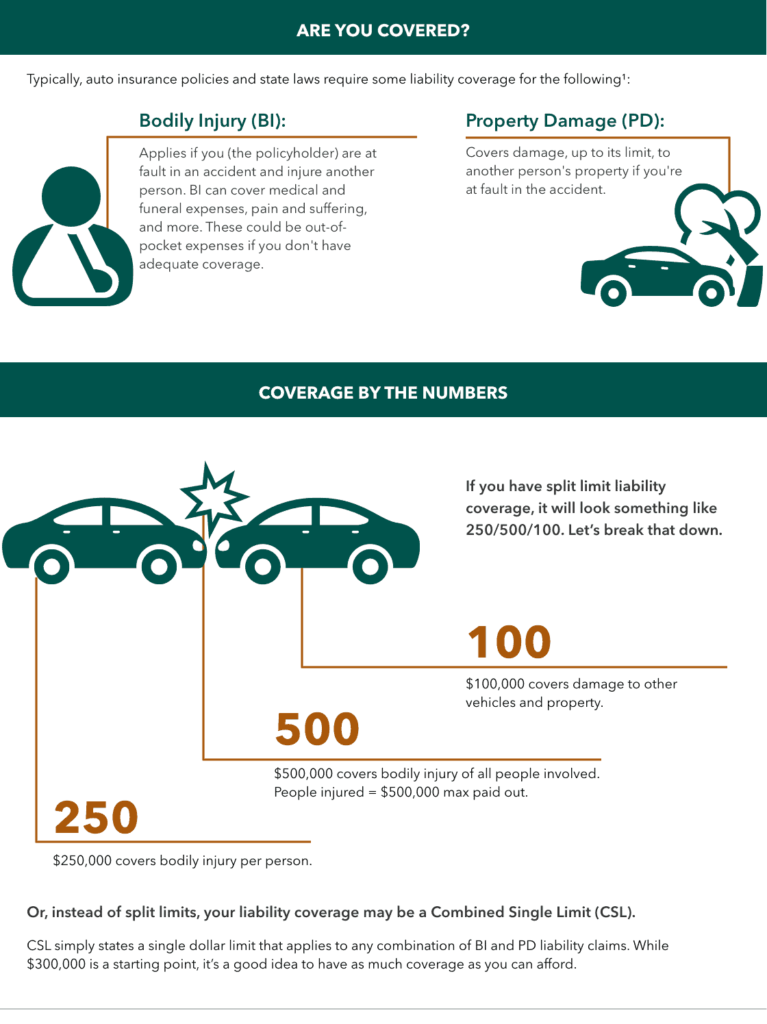

In that case, you'll desire to get even more insurance coverage. The nonprofit Consumers' Checkbook, among others, suggests buying insurance coverage of at least 100/300/50, just in case.

It's stood for on your plan as the third number in that series, so a 25/50/20 plan would supply $20,000 in coverage. Some states need you to have as little as $10,000 and even $5,000 in residential or commercial property damages obligation insurance coverage, however $20,000 or $25,000 minimums are most common. Once again, you might desire to get more insurance coverage than your state's minimum (cars).

7 Easy Facts About Minimum Auto Insurance Requirements - Department Of ... Explained

A commonly suggested degree of residential property damage coverage is $50,000 or more if you have substantial assets to safeguard. Medical Repayments (Medication, Pay) or Individual Injury Defense (PIP) Unlike bodily injury responsibility insurance coverage, medical settlements (Medication, Pay) or personal injury security (PIP) covers the expense of injuries to the motorist and also any kind of guests in your cars and truck.

Whether medical payments or PIP protection is mandatory, optional, or also offered will depend on your state. In Florida, for example, chauffeurs have to lug at least $10,000.

, where $10,000 in protection might be inadequate if you're in a major mishap. Crash Coverage Crash insurance coverage will pay to repair or replace your automobile if you're entailed in a crash with another automobile or strike some various other things.

If you have an automobile financing or are leasing the auto, your loan provider may need it. When you have actually paid off your lending or returned your rented auto, you can drop the coverage. Also if it's not required, you may want to acquire accident protection. If you would certainly have difficulty paying a large repair service costs out of pocket after a mishap, crash coverage could be good to have.

Not known Facts About How Much Auto Insurance Coverage Do I Need?

The rate of accident insurance coverage is based upon the value of your automobile, and it typically includes a deductible of $250 to $1,000. If your auto would cost $20,000 to change, you would certainly pay the initial $250 to $1,000, depending on the insurance deductible you selected when you acquired your plan, and the insurer would be accountable for as much as $19,000 to $19,750 after that.

In between the expense of your annual costs and also the insurance deductible you 'd have to pay of pocket after a mishap, you can be paying a lot for extremely little protection - credit score. Even insurance provider will tell you that going down collision coverage makes good sense when your vehicle deserves less than a few thousand dollars - insurance affordable.

That may be, for instance, a fire, a flooding, or a falling tree. It also covers auto burglary. Similar to thorough protection, states do not require you to have collision coverage, but if you have a car financing or lease, your loan provider might require it. As well as again, when you've settled your financing or returned your leased cars and truck, you can go down the insurance coverage.

You'll additionally desire to consider just how much your auto is worth compared with the price of covering it year after year. Uninsured/Underinsured Vehicle Driver Coverage Just because state regulations need motorists to have obligation insurance coverage, that doesn't indicate every chauffeur does.

Insurance Requirements - Virginia Dmv Fundamentals Explained

That is where this kind of insurance coverage comes in. Some states need drivers to lug uninsured motorist insurance coverage (UM).

If your state requires uninsured/underinsured motorist coverage, you can get even more than the called for quantity if you desire to - laws. You can additionally acquire this protection in some states that do not require it. If you aren't required to purchase uninsured/underinsured motorist protection, you might wish to consider it if the insurance coverage you already have would want to pay the costs if you're included in a serious mishap.

Other Types of Insurance coverage When you're shopping for car insurance coverage, you may see some various other, totally optional kinds of insurance coverage. Those can include:, such as towing, if you have to lease a car while yours is being fixed, which covers any kind of distinction between your car's cash worth as well as what you still owe on a lease or financing if your car is a failure Whether you require any one of those will rely on what various other resources you have (such as membership in a vehicle club) and exactly how much you might manage to pay out of pocket if you must (dui).

Whether to acquire greater than the minimum needed insurance coverage and also which optional kinds of protection to consider will certainly rely on the properties you require to shield along with just how much you can afford to pay (cheaper car insurance). Your state's car department internet site must explain its requirements as well as might provide other advice particular to your state.

The Greatest Guide To Automobile Insurance - Official Website

A car insurance coverage can include numerous different sort of coverage. Your independent insurance representative will certainly provide professional suggestions on the type and also amount of cars and truck insurance coverage you ought to have to fulfill your individual requirements and comply with the regulations of your state. Below are the major type of protection that your plan may consist of: The minimum coverage for physical injury varies by state and might be as low as $10,000 per person or $20,000 per crash.

If you wound a person with your cars and truck, you can be demanded a lot of cash. The quantity of Liability coverage you lug must be high adequate to safeguard your assets in case of a mishap. A lot of professionals advise a restriction of at least $100,000/$300,000, yet that might not suffice.

If you have a million-dollar house, you might lose it in a suit if your insurance policy protection is insufficient. You can get added insurance coverage with a Personal Umbrella or Personal Excess Liability policy. The greater the worth of your properties, the a lot more you stand to shed, so you require to get liability insurance coverage appropriate to the worth of your possessions - cheaper auto insurance.

You don't have to find out just how much to get that depends on the vehicle(s) you guarantee. You do need to choose whether to acquire it and also exactly how large an insurance deductible to take. The higher the insurance deductible, the lower your premium will certainly be. Deductibles typically vary from $250 to $1,000.

Fascination About Car Insurance Coverage Types - Progressive

If the cars and truck is only worth $1,000 as well as the deductible is $500, it might not make feeling to acquire accident insurance coverage. Accident insurance is not usually needed by state law. Covers the price of miscellaneous damages to your cars and truck not created by a collision, such as fire and also theft. Similar to Crash protection, you require to pick an insurance deductible.

Comprehensive insurance coverage is usually offered along with Crash, and the 2 are frequently described with each other as Physical Damage coverage. If the cars and truck is leased or funded, the leasing firm or lending institution may require you to have Physical Damage insurance coverage, despite the fact that the state regulation may not need it. Covers the cost of healthcare for you and also your guests in the event of a crash.

Consequently, if you pick a $2,000 Medical Expenditure Limitation, each traveler will have up to $2,000 coverage for clinical cases resulting from a mishap in your vehicle. If you are involved in a mishap and also the other driver is at mistake however has inadequate or no insurance policy, this covers the gap in between your prices and also the various other chauffeur's protection, approximately the limits of your protection (automobile).

The restrictions needed and also optional restrictions that may be offered are set by state legislation. This coverage, needed by regulation in some states, covers your clinical costs and those of your guests, regardless of that was liable for the mishap - cheap insurance. The limits needed and optional limits that might be available are established by state regulation.

The Best Strategy To Use For Your Guide To Understanding Auto Insurance In The ... - Nh.gov

When it comes to cars and truck insurance, the age-old inquiry is, How much vehicle insurance coverage do I require? Should you simply obtain the most inexpensive choice? We're gon na fire straight with you: Saving money isn't the only component of buying automobile insurance (cars). You need coverage that actually covers you, the kind that safeguards you from budget-busting automobile wrecks.

You're either covered or you're not. One of the huge reasons it's hard to get the appropriate coverage is because, let's face it, auto insurance policy is confusing. That's why we're mosting likely to show you exactly what you need. For starters, the majority of drivers should contend least 3 kinds of automobile insurance coverage: obligation, thorough and accident.

Why You Required Car Insurance coverage Driving about without vehicle insurance coverage is not just dumb with a funding D, it's additionally prohibited. Yet one in 8 Americans drives without some kind of automobile insurance in position.1 Don't do this. There are severe repercussions if you're caught on the road without vehicle insurance.

We advise having at the very least $500,000 worth of overall insurance coverage that consists of both kinds of responsibility coverageproperty damages obligation and bodily injury liability. car. That means, if an accident's your fault, you're covered for costs related to repairing the various other driver's automobile (residential property damages) as well as any expenses related to their lost incomes or medical expenses (bodily injury).

Some Known Details About What Does Auto Liability Insurance Cover?

Here's what we state: If you can't replace your vehicle with cash money, you need to obtain collision. The only time you may not require crash is if your auto is paid off and, again, you could replace it from your cost savings.

Presently, there are 22 states where you're either called for by law to have PIP or have the option to buy it as an add-on insurance.5 If you stay in a state that requires you to carry PIP, you should make the most of the insurance coverage if you ever require it - insurance company.

So despite the fact that they 'd be reducing you a quite huge check, it still wouldn't be adequate to repay your car loan. That's because brand-new automobiles shed greater than 20% in value in the very first year.7 Yikes! Space insurance policy loads this "void" by covering the remainder of what you still owe on your funding.

If you think you'll need this back-up plan in area, it's not a poor idea to include this to your plan. Pay-Per-Mile Insurance coverage If your auto often tends to sit in the garage collecting dirt, you may want pay-per-mile coverage. With this insurance coverage, a general practitioner gadget is set up in your automobile so you're billed per mile, rather than a yearly estimate. car insured.