GPA or above will get a Great Trainee Discount. Additionally, there are vehicle driver training discount rates for motorists that complete an authorized motorist training course. Shocks are excellent, however not when it's the day your son or child is getting certified and also you learn that your insurance coverage costs is raising significantly.

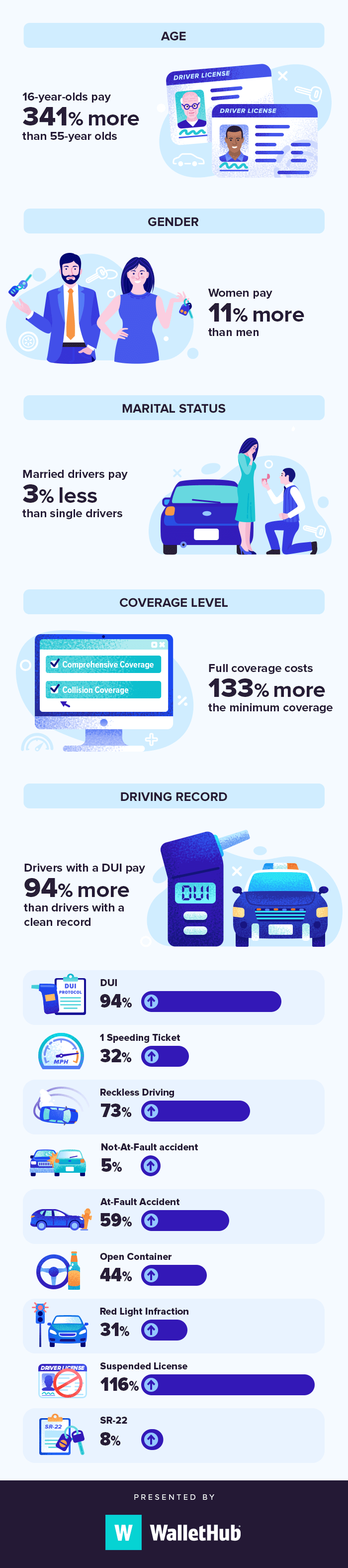

Typically, including a 16 years of age chauffeur can raise your costs by $500-$1000 or more for the policy term. Teenagers and also inexperienced drivers statistically are at a higher threat for more expensive mishaps as well as that indicates your insurance coverage premium will certainly show that risk in the price - dui. Higher deductibles can constantly provide an instant premium cost savings on your plan.

This may not specifically be a means to reduce your premiums currently, but it can conserve you cash in the future if you or any kind of other member of the family in your residence are ever associated with a costly claim or claim down the road - cheaper car insurance. What is usage-based insurance policy? You may have seen commercials from different carriers about devices that you can place in your car which track your driving behaviors and also supply a personalized insurance coverage rate or discount rate based on those habits.

Published on December 26, 2019 You are adding your teen to your vehicle insurance coverage. The declaration is lots of people's best concerns. It's the minute they've dreaded coming as a result of the stress and anxiety it brings on. The high costs are unpreventable, there are ways to lower them, and also you should not have to sustain it for too lengthy.

Everything about Car Insurance For Teens - Root Insurance

Likewise, please note that these percentages are the ordinary percent rise for adding a 16-year old chauffeur (affordable car insurance). As your chauffeur grows older, you can anticipate reductions to their prices. We understand that isn't what you desire to listen to, however there are alternatives offered to reduce the expense of including a teen to your vehicle insurance coverage.

Qualifications for these discount rates can include keeping a certain GPA or finishing a carrier accepted risk-free driving course. If you have an university student who lives greater than 100 miles away from home without a car, you may also obtain a discount as they might not be around to utilize the auto as usually.

insurance insurance affordable affordable car insurance automobile

insurance insurance affordable affordable car insurance automobile

Some autos are more pricey to insure than others. This decision can have a substantial influence on how significantly your price rises when you add your teen. It could be time to give the family members minivan! When looking for your teenager's first cars and truck, you want something bigger in size as well as slower.

There's no demand to start paying when you do not need to. Inspect with your service provider to see what their policies are as they vary from each various other. Knowing these guidelines can aid you recognize what costs to anticipate and when. This information is frightening and stressful, however we are right here to help - money.

The Single Strategy To Use For How Much Does It Cost To Add A Teen To My Auto Policy?

Contact us to receive a free quote today. This access was posted in Auto Insurance coverage. Exactly How Can Avery Hall Help You? Thanks for your request! We'll communicate quickly - auto.

This provides you a good jumping-off point when investigating insurance. Is it better to guarantee your teen on your existing policy or a different policy? Normally, it is more Look at more info affordable to add a teen to your existing plan than to get different insurance policy for the young chauffeur.

It may still be less costly to have the entire family members on the very same policy, just a different one from what you have. By maintaining your teenager on your policy, you can make use of specific discounts (i. e a multi-vehicle discount rate). What affects automobile insurance coverage costs for 16-year-old motorists?- A lot of insurance providers provide a price cut for par-taking in a safe drivers course.- If your teenager still lives at residence, you can conserve thousands of dollars by including them to your plan.- States differ in their pricing.

Money-saving suggestions for teen insurance, Below are some easy discount rates many people can get. Make sure to make use of any type of discounts you can to reduce your rates as high as feasible.- By having great grades, your teen shows comprehending responsibility. This certifies them for a discount rate with most insurance provider- Look right into price cuts provided to teenagers who participate in "Driver's Ed" or comparable training courses- Does your teenager just drive limited hrs such as to and also from institution? You can include them to your car insurance policy as an "Periodic Driver" to obtain a discount- For pupils who are "away at college", some companies will reduce your rates when they are away- If you recognize your teenager will not be driving typically, ask your insurance firm concerning a low-mileage discount.

The Ultimate Guide To How Much Is Car Insurance For A 16-year-old? (& How To Save)

You can conserve even more by dropping extensive and also collision protection, Exactly how to start your search, Locating the finest and least expensive automobile insurance coverage for a 16-year-old motorist, can be a difficulty. It needs research study, shopping around, and also requesting applicable price cuts. Everyone is different. What might work well for your friend can be a horrible offer for you.

This modification presents a difficulty for lots of parents when faced with adding a teenager driver to their cars and truck insurance plan. A research study by supplies a serious number for moms and dads including a teenager to insurance policy complete coverage car insurance policy costs raise an average of 151% when adding a 16-year-old teen chauffeur - car.

How to Include a Teen Vehicle Driver to Your Cars And Truck Insurance Policy, Follow these actions for including a teenager chauffeur to your car insurance policy. Prior to your teenager obtains their student's permit, have a discussion with an insurance policy agent about when to add the teen to the policy. Some business might suggest the teenager be included upon obtaining their authorization, while others may require you to wait up until the teenager receives their vehicle driver's permit.

These programs normally track your speed, hard brakes as well as velocity, still time, as well as other driving metrics.

Some Known Details About How Much Is Car Insurance For A 16-year-old? (& How To Save)

A handful of states California, Hawaii, Massachusetts, Michigan, Montana, North Carolina, and also Pennsylvania prohibit the usage of gender as a vehicle insurance rating aspect. The state you live in will certainly also play a big duty in the auto insurance rate you spend for your teenager. Some states have lower ordinary vehicle insurance policy costs generally, so the expense for including a teen is typically lower too.

Besides the teen motorist security and discount programs, there are a number of other discounts teenagers can commonly qualify for: Full time students with a B or over grade point standard in school can typically obtain a discount from insurance companies for having good qualities in senior high school or college, as long as the chauffeur is single and also under 25. vans.

insurance affordable insured car cheapest auto insurance cheaper cars

insurance affordable insured car cheapest auto insurance cheaper cars

vehicle insurance cheaper auto insurance cheapest car affordable car insurance

vehicle insurance cheaper auto insurance cheapest car affordable car insurance

Can a young adult get their very own auto insurance coverage plan? State regulations differ when it comes to a teen's capacity to sign for insurance coverage.

As a matter of fact, your teenager will likely have a higher costs compared to including a teenager to a moms and dad or guardian plan. There are situations where it may make feeling for a teenager to have their very own plan. Dynamic mentions two: You have a high-end sports vehicle. On a solitary strategy, all chauffeurs, including the teenager, are guaranteed against all cars.

Some Known Questions About How Much Is Car Insurance For A 16 Year Old? - Compare.com.

Teens pay even more for vehicle insurance coverage than grown-up vehicle drivers since insurance policy companies consider them risky. There are ways teen drivers can conserve on their auto insurance costs.

Weigh against the truth that young motorists are much more most likely to obtain right into crashes. When you obtain into an at-fault accident, you have to pay the insurance deductible amount. Increasing your insurance deductible from $500 to $1,000 will certainly lower your annual premium by roughly $400. You can additionally drop extensive and crash insurance coverage if the auto isn't funded and also unworthy much.

A car with a high safety ranking will be less expensive to insure. Usage com's list of cars and truck versions to discover the most affordable autos to guarantee. This mostly involves the auto's price, how very easy it is to fix and assert records. likewise has a listing of made use of autos. This isn't really a popular option for an excited teenager motorist, but it deserves thinking about.

Nevertheless, you should additionally recognize the insurer still bill greater prices for the initial few years of the certificate. Another means to reduce your insurance costs is to get on your own of the discounts offered. A few of them are mentioned listed below, Discounts for teenager vehicle drivers, We've recognized the most effective discounts for teen vehicle drivers to obtain cost effective cars and truck insurance coverage.

The 3-Minute Rule for 4 Things To Know Before Adding Your Teen To Your Car ...

That's $361 usually. You can take added vehicle driver education or a defensive driving training course. This implies go above and beyond the minimal state-mandated motorists' education and training. In some states, discounts can run from 10% to 15% for taking a state-approved vehicle driver enhancement class. On-line classes are a practical alternative but talk to your service provider initially to see to it it will certainly bring about a price cut.

You might obtain a discount around 5% to 10% of the trainee's premium, yet some insurance companies promote up the 30% off. The ordinary student away at institution price cut is more than 14%, which is a savings of $404.

A number of car insurer offer price cuts if you allow a telematics tool to be put in your vehicle so they can monitor your driving habits. This is thought about "pay-as-you-drive." This can surrender to a 45% discount rate. With pay-per-mile, you'll pay for the distance you drive, rather than driving patterns.

There is prospective to save - insurance companies. If the student prepares to leave a cars and truck in the house and the university is greater than 100 miles away, the university student could qualify for a "resident pupil" discount or a trainee "away" price cut, as mentioned above. These discount rates can reach as high as 30%.

An Unbiased View of How Much Does Car Insurance Cost For A 16-year Old In ...

Both discounts will need you to contact your insurance provider so they can begin to apply the discounts. Learner's authorization insurance policy, You can get insurance with a license, but many automobile insurance firms include the permitted teen on the parents' policy without any type of activity.

When that time comes, be certain to check out the rest of this post for support on alternatives and also discount rates. Also, it might be smart to call your insurance coverage service provider for all alternatives readily available to you. Go with no insurance coverage savings alternative, It's feasible to tell your insurance coverage business not to cover your teenager, however it's not a given.

insurance car insurance cheapest car insurance cars

insurance car insurance cheapest car insurance cars

Through a recommendation to your policy, you and your insurer equally agree that the driver isn't covered, which indicates neither is any type of crash the driver causes. Not all business allow this, as well as not all state do either. Adding a teen driver cheat sheet, Speak with your carrier as quickly as your teen obtains a driver's license.

com. Think about all insurance coverage alternatives. Think of increasing your deductible. Seek and pile as lots of discount rates as possible. Speak to your teen early as well as typically concerning safety and security. Urge they drive a secure auto. Things to think about prior to selecting an auto insurance provider for your teenager Chances are that your auto insurance provider will contact you.

10 Simple Techniques For The Cheapest Car Insurance For Teenagers In 2022 - Business ...

Regularly asked concerns regarding teenage insurance, Do you have to add an adolescent driver to your insurance coverage? Yes, you'll need to include your teen to your car insurance plan if they deal with you and drive your vehicle. Some states will certainly need you to add your teenager chauffeur as an added insured individual when they get their learner's authorization.

It is not advised to buy a teenager their own insurance policy because it can be very costly. Insurer charge teens extra for auto coverage than adults due to the fact that they think drivers under 25 have a higher opportunity of creating mishaps. Should I add my 16-year-old to car insurance coverage? A lot of states require you to include your 16-year-old teen to your automobile insurance as quickly as they obtain their permit (trucks).

Also if it is not compulsory, it's constantly a great concept to make certain you're covered by auto insurance policy. Exactly how to get car insurance coverage for a teenager? It is possible for a young adult to obtain vehicle insurance coverage with a license, however most insurance companies will consist of the permitted teen on their moms and dad's policy with no other rules.

Exactly how a lot does it cost to add a 17-year-old to automobile insurance policy? The ordinary auto insurance policy cost for a 17-year-old for complete protection is $5,836 a year. Your auto insurance policy price will depend upon where you live, the insurance coverage level you pick, the make and also design of your automobile, to name a few elements.

The 30-Second Trick For Best Cheap Car Insurance For Teens And Young Drivers In 2022

That's because 16 is the birthday when teens can start driving in Ohio. And also that implies you have to figure out your teenager's auto insurance situation. Will teen vehicle insurance policy cover enough to keep my child protected?